The global pandemic and political uncertainties have changed Hong Kong’s luxury market landscape: LVMH’s come back, the impact of digitalization and the experiential approach

The shift in marketing strategy and current market position in the global luxury market: from Asian market hub to localized luxury

Since the reopening of Hong Kong and mainland China earlier this year until August, the city has received 20.5 million tourists. The return of high-profile luxury fashion events and the opening of stores by renowned brands in the city’s commercial districts raises speculation about a potential retail and tourism revival.

Speculations about luxury fashion brands relocating resources from Hong Kong to mainland China are attributed to China’s growing dominance in the global luxury market. This shift in marketing strategy from a regional hub model to a local-to-local approach is also linked to geopolitical and economic uncertainties worldwide. However, it is emphasized that the establishment of more stores and operations in China is not a sign of Hong Kong losing its status as the luxury hub for Asia. Instead, it reflects the increasing distribution channels and accessibility for local Chinese consumers.

Despite the positive indicators highlighted by Euromonitor, predicting a return to pre-COVID-19 luxury sales levels by mid-2024, challenges remain. General consumer sentiment may remain weak due to factors like high-interest rates and a poor wealth effect, especially in real estate and equities, as well as uncertainties in Hong Kong’s tourism sector, which once accounted for 4.5% of the city’s GDP in 2018, and has dropped to around 0.1% in 2021.

Hong Kong’s luxury market analysis: experiential retail approach

Reviving the shopping hub and attracting tourists will require a strategic shift towards experiential retail, as emphasized by K11 Musea’s successful approach. This business model prioritizes the creation of lasting and captivating customer interactions, moving beyond mere product transactions. The concept revolves around establishing a distinctive, immersive, and participatory shopping atmosphere that prompts customers to forge a more profound connection with the brand.

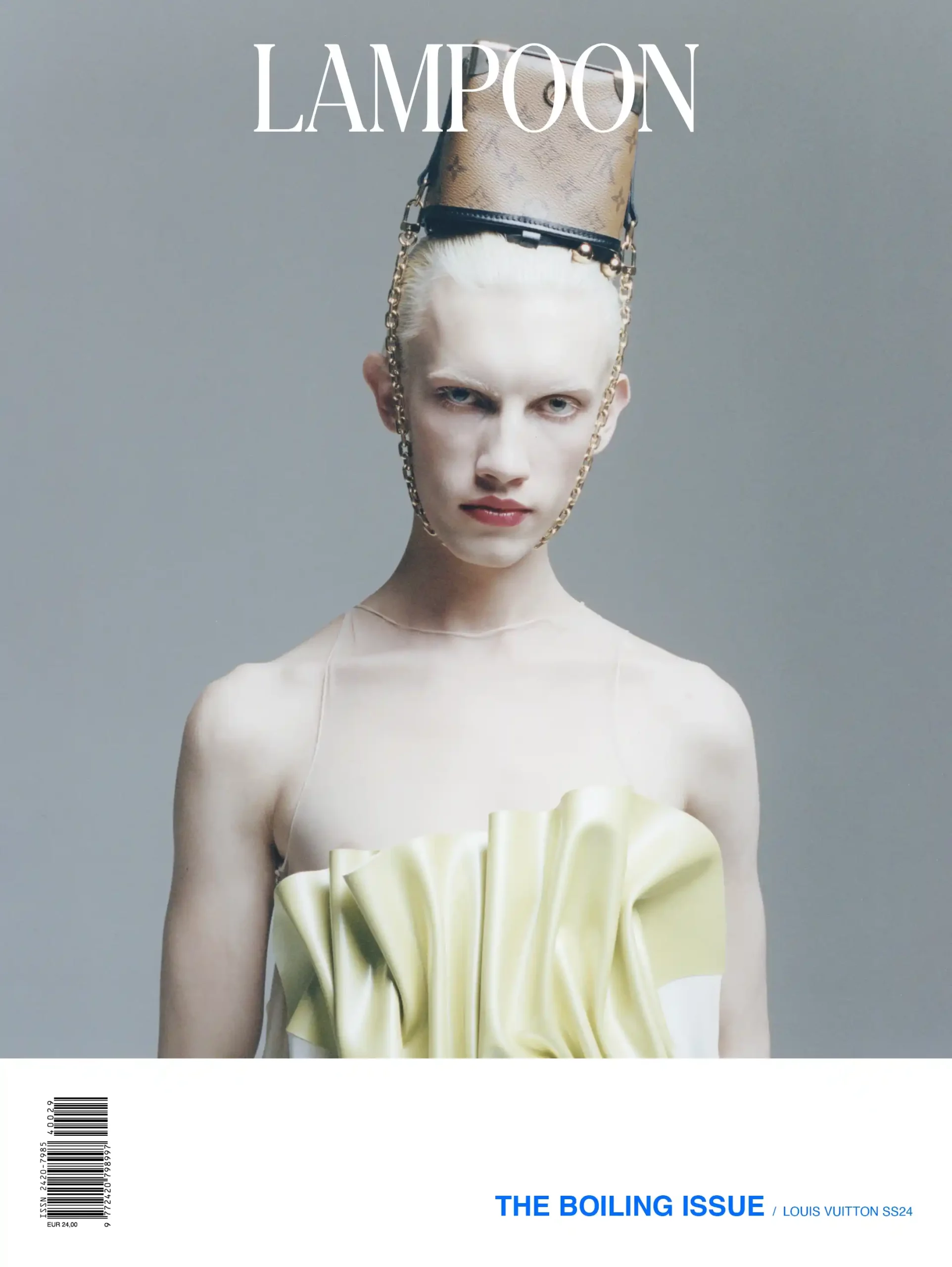

This way, local brands are focusing on capturing the essence of Hong Kong’s culture to elevate its standards and compete on the global stage. Also, Louis Vuitton collaborated with K11 Musea for the men’s pre-fall collection 2024 event and it was seen as a strategic move given the reported sales surpassing pre-pandemic levels by 20 percent in K11’s Tsim Sha Tsui-based shopping malls.

Creative directions and guidelines coming from headquarters in global fashion capitals like Paris, Milan, and New York for luxury fashion and Switzerland for luxury watches, are accompanying the shift which is primarily seen as a business operational decision rather than a response to changes in consumer shopping behavior.

Hong Kong’s position as a luxury market hub is reemerging after years of political protests and Covid-19 restrictions – Hong Kong’s market analysis and The purpose economy

Despite facing challenges during the 2019 political unrest and subsequent stringent anti-Covid measures from 2020, which temporarily impacted sales of luxury goods, and luxury fashion above all, Hong Kong’s role in the global luxury market has seen a resurgence in per capita spending on luxury items as pandemic restrictions eased in 2022.

Hong Kong has struggled since then to regain its appeal as a global retail paradise, with an estimated cost of $360 billion damage caused by years of economic isolation.

However, in terms of luxury jewelry, Hong Kong emerged as the leader in the Asian market in the APAC (Asian Pacific) region, witnessing a growth rate of 25.8% from 2021 to 2022. The city also maintained its position as the region’s leader in wearable luxury, exhibiting the highest demand for luxury fashion pieces among both men and women.

The report by Euromonitor not only predicts that Hong Kong’s business scene will regain pre-pandemic levels of luxury sales by mid-2024 but also anticipates the city to maintain its lead as the location with the highest per capita spending on luxury goods until 2028.

Hong Kong Renaissance – Hong Kong’s luxury market and fashion arena

In August 2023 Euromonitor published a Hong Kong’s market analysis stating that the region has reclaimed its position as the market with the highest per capita expenditure on luxury goods. This comes after briefly losing the top spot to Switzerland and the United Arab Emirates.

Renowned globally as a luxury hub, Hong Kong has historically attracted high-net-worth individuals due to its strategic location – in the Asian market and worldwide –, robust economy, favorable tax policies, and reputation as a premier shopping destination.

Hong Kong’s demand for luxury goods is driven by mainland Chinese visitors, and the city has adapted to post-pandemic market trends, welcoming a consistent flow of tourists from mainland China.

Euromonitor’s report indicates that among various luxury categories, personal luxury items and premium and luxury cars saw the highest sales.

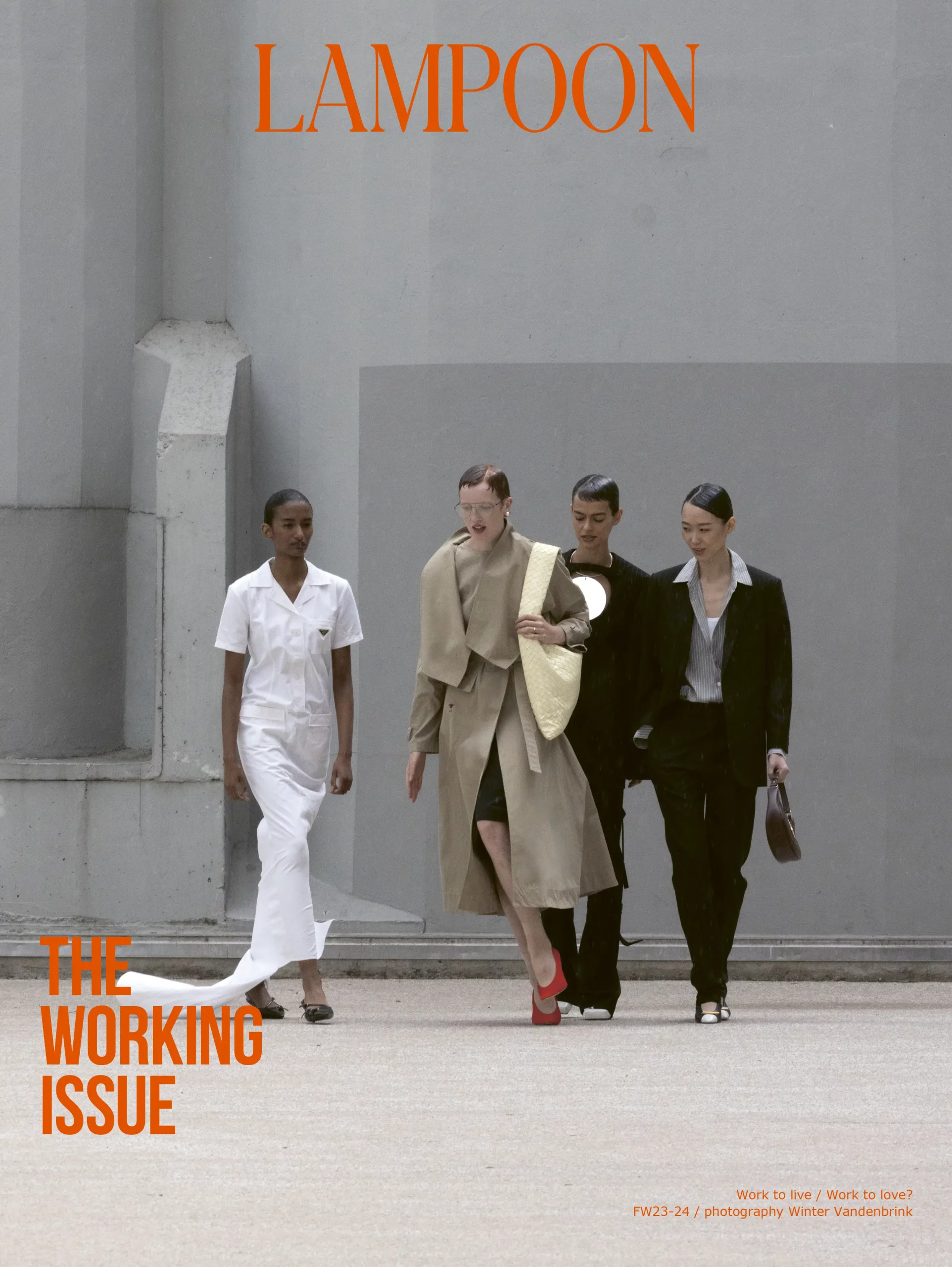

The return of Hong Kong’s role in the global luxury market and potential retail and tourism revival

For its 2024 men’s collection, Louis Vuitton – one of the world’s largest luxury fashion brands – landed in Hong Kong with Pharrell Williams’ second collection as men’s creative director. He converted the renowned Avenue of Stars harbour-front promenade into an urban beach, complete with a sandy runway. Williams’ seasonal vision featured sets inspired by navels, paying homage to Hawaiian-style tropical shirts, a chorus of 50 ukuleles to serenade the guests, and as the event approached its conclusion, a fleet of drones to illuminate the sky, underscoring the fascination with light shows in the region.

The presence of big fashion events elevates Hong Kong’s status as a global fashion and luxury hub, attracting international attention and fostering a vibrant fashion ecosystem. These events contribute to The purpose economy by generating substantial revenue through increased tourism, hotel bookings, dining and retail spending.

This extravagant display mirrors LVMH Moet Hennessy Louis Vuitton SE’s growing dedication to the area. Louis Vuitton’s CEO, Pietro Beccari, emphasized Hong Kong’s significance as a regional retail and business hub, expressing the value of celebrating the city through their show.

Also Dior – another LVMH’s brand – is set to showcase its men’s pre-fall collection also in Hong Kong in early 2024, though the exact venue and date are yet to be confirmed.

Hong Kong’s market analysis: the city as a gateway for luxury goods to mainland China

Mainland Chinese visitors, constituting approximately 80 percent of total inbound travelers and a crucial element of the city’s retail landscape, have been slow to return to Hong Kong. When they do, they tend to gravitate towards more subdued or experiential activities. In response, LVMH is reallocating resources away from the financial hub, redirecting investments toward burgeoning metropolises on the border.

As for now, the Louis Vuitton show has the potential to reignite interest in the city as a luxury destination: it has already garnered popularity in China, with a hashtag for the event topping trending topics on Weibo, attracting local enthusiasts without invitations to get a glimpse from numerous boats on the harbour.

Hong Kong reshaping the future of business – Hong Kong is the capital of luxury tourism

Social attraction is considered a currency in the fashion community. The decision by the owner of LVMH to move its hub from Hong Kong to China is portrayed as a strategic business move within The purpose economy rather than a shift in consumer behavior. The increasing reliance on digital platforms for luxury spending, exceeding 60%, necessitates more localized adaptations for global and regional campaigns due to variations in social media, e-commerce, and other digital platforms across different countries.

Differences in government regulations, digital touchpoints, media indexes, and the availability of second-party data contribute to the shift from a hub approach to a local-to-local approach in luxury advertising and marketing. The evolving preferences of future generations, particularly Gen Z, from treating luxury goods as aspirational to compatible, further emphasize the need for a local approach to remain relevant.

Hong Kong

A special administrative region of the People’s Republic of China under a capitalist economic system. The city holds one of the most prestigious luxury markets in East Asia and is the capital of luxury tourism.